RIBA FREE PAKISTAN

Al-Sadiq (a.s) Institute of Islamic Banking, Finance and Takaful in collaboration with Al-Nasay Solutions organized conference on ‘RIBA-FREE PAKISTAN’ on Sunday the 27th of November 2020 at Avari Towers, Karachi to have a collective dialogue among all stakeholders on the new horizon and strategy for proper implementation of Federal Shariat Court’s decision and emerging opportunities.

The speakers discussed the importance of promoting Islamic banking and finance in order to achieve financial inclusion and economic growth. They noted that many people prefer Islamic banking due to its prohibition of interest, and that Islamic finance has the potential to provide Shari’ah-compliant solutions for businesses that avoid traditional banking for this reason. The speakers also highlighted the potential for Islamic finance to facilitate fiscal responsibility and tax mobilization through the use of Islamic public finance structures. They discussed the increasing competitiveness of Islamic finance in certain sectors such as housing finance, car finance, and mutual fund investments, and emphasized the need for collaboration between scholars and academics to further develop and research Islamic finance. Finally, the speakers suggested that the establishment of a constitutional body may be necessary to effectively advocate for the transformation to a Riba-free economy in Pakistan.

Islamic finance segments where Islamic finance’s share has increased are becoming price/return competitive. For instance, housing finance, car finance and mutual fund investments. Hence, scaling through transformation to Riba free economy may further make Islamic banking and finance more competitive in price.

Research and Development has increased in Islamic finance. It has introduced unique financial products through innovation like Umrah Finance, Interest Free Loans through Akhuwwat etc.

Academic research needs to align with practice for more practical oriented research. Collaboration between Ulema and academic economists is also going to create synergies whose benefits can be seen in materialization of Islamic banking. There is also insightful literature available in Arabic, Persian and Urdu. Researchers need to give weight to all such extant literature.

Renowned personalities addressed the ceremony including:

- Master of Ceremony – Muhammad Raza (Group Head Customer Support, Meezan Bank Limited)

- Omer Mustafa Ansari (Secretary General, Accounting and Auditing Organization for Islamic Financial Institutions – AAOIFI)

- Ashfaq Yousuf Tola (President, The Institute of Chartered Accountants of Pakistan)

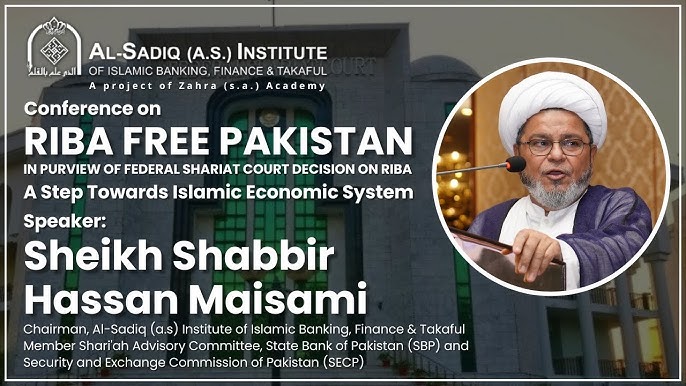

- Sheikh Shabbir Hassan Maisami (Founder and Chairman – Al-Sadiq (a.s) Institute)

- Mufti Irshad Ahmad Aijaz (Chairman Shari’ah Advisory Committee, State Bank of Pakistan and Security and Exchange Commission of Pakistan)

- Ahmed Ali Siddiqui (Head, Product Development and Shariah Compliance, Meezan Bank Limited)

- Rizwan Ahmed Naqshbandi (Senior Joint Director, Legal Division Head Banking Policy & Regulations Department)

- Farid Ahmad Paracha (Senior Economist and Ex-Senator)

- Muhammad Islam Ahmed (Ex-Senior Joint Director State Bank of Pakistan & CEO, Al-Nasay Solutions Pvt. Ltd)

- Syed Aamir Ali (President & CEO, BankIslami Pakistan Limited)

- Nayyar Hussain Zaidi (Executive Director, Salaam Takaful Limited)

- Raheel Q Ahmed (Managing Director & CEO, OLP Modaraba (formerly ORIX Modaraba)

- Muhammad Faisal Shaikh (Head Islamic Banking, Faysal Bank Limited)

- Muhammad Yahya Khan (Group Head Digital Banking, Bank Alfalah Limited)

- Faisal Rathod (Head of Islamic Banking Initiative and Strategy, Samba Bank Limited)

- Jawaid Iqbal (Senior Member, Executive Committee – Al-Sadiq (a.s) Institute)

- Mufti Waseem Akhtar (Head Mufti, Dar-ul-Ifta Faizan-e-Shariat & Research Scholar, Jamia-e-Naeemia)

- Muhammad Omar (Joint Director, Economic Policy Review Department, State Bank of Pakistan)

- Muhammad Shujaat Mubarik (Dean, College of Business Management – IoBM)

- Salman Ahmed Shaikh (Director – Islamic Economics Project and Assistant Professor of Management Sciences, SZABIST)

- Farhan-ul-Haq Usmani (Executive Vice President & Head of Shariah Audit, Meezan Bank Limited)

- Faisal Sultan Qadri (Research Economist, Applied Economics Research Centre – University of Karachi)

- Azeem Iqbal Pirani (CEO Pak Qatar Family Takaful Ltd)

- Molana Syed Mazhar Abbas (Shariah Scholar and Member, Executive Committee – Al-Sadiq (a.s) Institute)

Prof. Dr. Hussain Mohi-ud-Din Qadri (Deputy Chairman Board of Governance, Minhaj University Lahore)